The purchasing manager may advocate purchasing in bulk to obtain volume purchase discounts. A pull system that only manufactures on demand requires much less inventory than a "push" system that manufactures based on estimated demand. The inventory accounting method used, combined with changes in prices paid for inventory, can result in significant swings in the reported amount of inventory.įlow method used. Some portion of the inventory may be out-of-date and so cannot be sold.Ĭost accounting.

Inventory may be built up in advance of a seasonal selling season. The following issues can impact the amount of inventory turnover:

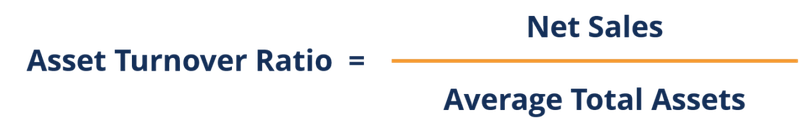

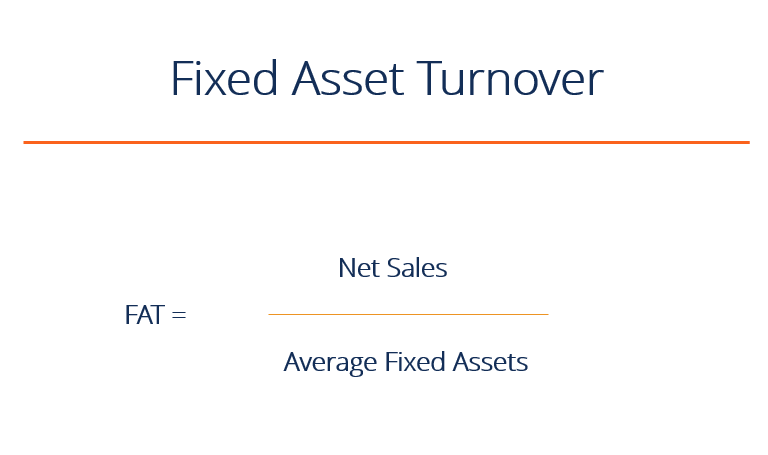

It can be used to see if a business has an excessive inventory investment in comparison to its sales, which can indicate either unexpectedly low sales or poor inventory planning. In other words, Sally’s start up in not very efficient with its use of assets.The inventory turnover formula measures the rate at which inventory is used over a measurement period. This means that for every dollar in assets, Sally only generates 33 cents. The total asset turnover ratio is calculated like this:Īs you can see, Sally’s ratio is only. Here is what the financial statements reported: The investor wants to know how well Sally uses her assets to produce sales, so he asks for her financial statements. Sally is currently looking for new investors and has a meeting with an angel investor. Sally’s Tech Company is a tech start up company that manufactures a new tablet computer. The fixed asset turnover ratio and the working capital ratio are turnover ratios similar to the asset turnover ratio that are often used to calculate the efficiency of these asset classes. Sometimes investors also want to see how companies use more specific assets like fixed assets and current assets. This gives investors and creditors an idea of how a company is managed and uses its assets to produce products and sales. The total asset turnover ratio is a general efficiency ratio that measures how efficiently a company uses all of its assets. To get a true sense of how well a company’s assets are being used, it must be compared to other companies in its industry. Some industries use assets more efficiently than others. Like with most ratios, the asset turnover ratio is based on industry standards. In other words, the company is generating 1 dollar of sales for every dollar invested in assets. Lower ratios mean that the company isn’t using its assets efficiently and most likely have management or production problems.įor instance, a ratio of 1 means that the net sales of a company equals the average total assets for the year. Higher turnover ratios mean the company is using its assets more efficiently.

This ratio measures how efficiently a firm uses its assets to generate sales, so a higher ratio is always more favorable. A more in-depth, weighted average calculation can be used, but it is not necessary. This is just a simple average based on a two-year balance sheet. Net sales, found on the income statement, are used to calculate this ratio returns and refunds must be backed out of total sales to measure the truly measure the firm’s assets’ ability to generate sales.Īverage total assets are usually calculated by adding the beginning and ending total asset balances together and dividing by two.

0 kommentar(er)

0 kommentar(er)