(People who are eligible, but preferred to wait and get the full credit with their tax return, could opt out of the monthly payments.) But even if you got a payment in July and then opted out of the remaining advance payments, you should still expect to get a letter, according to H&R Block. says people who received advance payments of the credit in 2021 will get letters. Here are some questions and answers about the expanded child tax credit and the 2022 tax filing season: Will everyone eligible for the child tax credit get a letter? In some cases, the agency said, it could take as long as four months.įilers can take at least two steps to help make tax season go more smoothly: File your return electronically and arrange for automatic deposit of your refund. In those cases, it is taking longer - sometimes much longer - than the typical 21 days to issue a refund. They include 2020 returns with errors and those needing “special handling,” like corrections to recovery rebate credits. 18, the agency still had 6.3 million unprocessed individual tax returns. “They’re starting this filing season still digging out of a hole from last filing season,” Ms. is still working through a backlog of returns from last year. But if you didn’t, or if you got less than the full amount, the letter - known as Letter 6475, Your Third Economic Impact Statement - will help determine if you can claim the money as a “recovery rebate credit” on your 2021 tax return.Īs the 2022 filing season approaches, the I.R.S. Most eligible people have already received the payments. The third batch of stimulus checks, of $1,400 per person, was sent beginning in March as part of the pandemic relief effort. is also sending a second letter later this month regarding the third round of economic impact payments, also known as stimulus checks.

Democrats had sought to continue the larger child tax credits after 2021 as an antipoverty program, but negotiations have stalled in Congress. Most people used the payments to buy food and clothing and pay for utilities, according to a report from the Urban Institute.

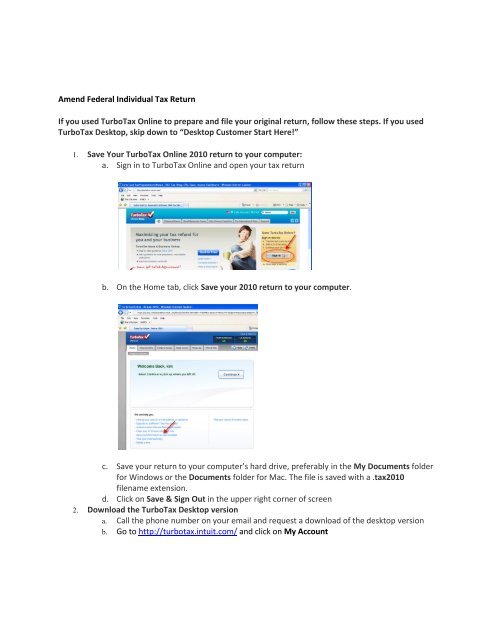

AMENDED TURBOTAX RETURN LICENSE

(You’ll need to verify your identity, using an ID like a driver’s license or a passport, and you’ll need a way to take a photograph of yourself and upload it.)

AMENDED TURBOTAX RETURN UPDATE

letter, you can go to the I.R.S.’s child tax credit update website and create an account to check your information online. If you got advance payments but don’t receive an I.R.S.

“It’s not going to be a quick fix,” she said. Be aware, however, that wait times for assistance may be lengthy. Since there is still time before returns can be filed, she said, taxpayers can try to contact the I.R.S. Collins said, noting that her office does not give tax advice. “They definitely should talk to their accountant,” Ms. numbers and then ask the agency to trace the payments in question so they could get the money once the difference was verified. Evenstad said filers who wanted to get at least part of their refund could choose to file with the I.R.S. “Amended returns take a long time, even under the best of circumstances,” he said. spokesman, advised against that approach because the agency already has a large backlog of amended returns to process, and wait times will probably lengthen once filers begin submitting returns for 2021. Filers would eventually get the correct amount from the credit, without delaying their entire refund.īut Eric Smith, an I.R.S. numbers, then file an amended return later with the amounts documented in the filer’s records. One option could be to file a return using the I.R.S. Collins heads the Taxpayer Advocate Service, an independent agency representing taxpayers inside the I.R.S. to flag the return for review, delaying the entire refund - not just the amount tied to the child tax credit, said Erin M.

But others may urge filers to use the amounts shown in their records, if they have documentation - like a bank statement - to show that they are accurate.

0 kommentar(er)

0 kommentar(er)